Climate Change, Discounting, and Net-Zero Fog

Net Zero objectives are impossible with the present trajectories.

If interested in AI, check my other page where I write on prospects for LLM tutors.

Please also subscribe to make sure you will not miss future posts. Subscription is free. Your email will not be used for other purposes. You will receive no advertisements.

-+-+-+-+

In all human history, we’ve had no problem quite like climate change. It may be an existential threat, yet it unfolds so slowly relative to human lifespans that nations can keep kicking the can down the road.

Instead of spending on prevention today, some argue it’s better to spend on remediation later—because of discounting. At a 5% discount rate, $1 today ≈ $10 in 48 years. So if prevention costs $1 now and the same damage could be remediated for less than $10 in 48 years, the purely economic calculus says “wait.”

I’ve long been uncomfortable discussing climate policy because debates too often devolve into blame and invective, with each side stonewalling opposing views. It’s clear that human activity is changing atmospheric composition and warming the planet. What to do next is less clear. If a flood is coming next week, we pile sandbags; we don’t move towns uphill or build new dams. If the flood is coming in 48 years, long-lead measures make sense. Likewise, if the world would burn next year without drastic cuts, we’d pull every plug and build renewables at any cost. But if the gravest harms are spread over decades, investing in better, cheaper future technology can be rational. I want to debate this as public policy—but that’s proven difficult.

The Narrative Problem

Fossil-fuel advocates often obfuscate. Some climate activists, in turn, cast any hesitation as heresy—even thoughtful scepticism about tactics becomes “denial.” The result is a debate that too often lacks nuance.

A (Qualified) Conspiracy Lens

From the 1970s onward, cheap labour drew manufacturing to developing countries. Around the same time, climate risk entered public discourse. Climate change wasn’t invented; it’s real. But in wealthy countries, parts of the ruling class also saw an opportunity: tax the carbon footprint of imported goods while manufacturing clean-tech domestically. Narratives are often crafted to steer public opinion; many fade, the plausible ones stick.

It was a tidy plan. Early U.S. consensus favoured preventative measures. Then two things happened: (1) a powerful conservative coalition (famously backed by the Koch brothers) opposed climate policy; and (2) the U.S. and Germany lost the renewables manufacturing race to China. Today China dominates several clean-energy supply chains. Perhaps this history explains why climate policy debates now feel incoherent—certainly so in Australia.

Net Zero Fog

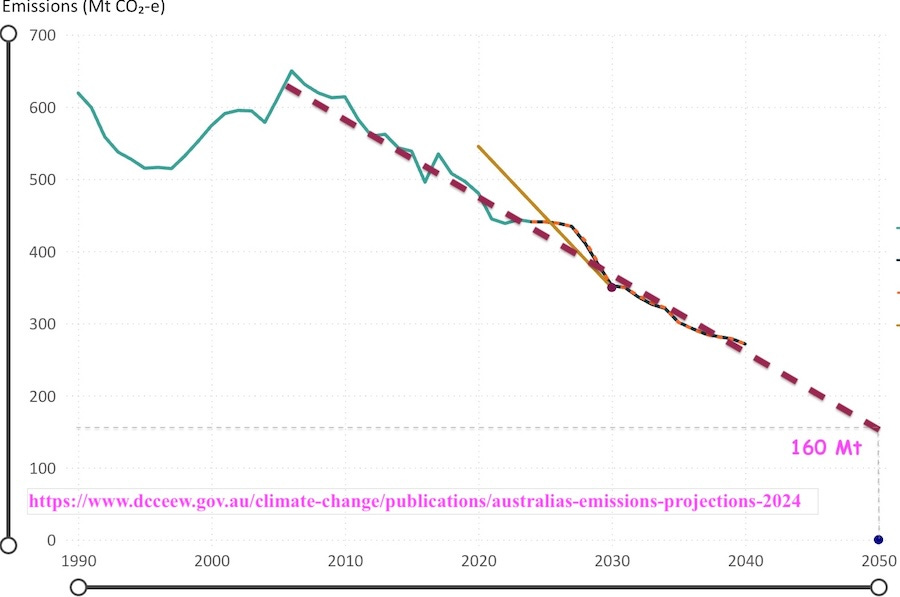

Australia aims for net-zero by 2050 (so does the EU). In Australia’s case, I don’t see a credible path on present trends. The following chart shows the progress so far:

Emissions have fallen more or less linearly since 2006. Extending that dotted trend line to 2050 yields not zero but about 160 Mt CO₂-e—and likely more, for several reasons:

Land use & agriculture. The easy gains look exhausted and may reverse.

Electricity. We’ve enjoyed “use solar when it’s sunny, lean on coal when it’s not” without much storage, because coal plants ramped down but stayed online. That flexibility is becoming untenable.

Curtailment. On some days renewable generation exceeds demand by wide margins. On Sunday, 14 Sept 2025, wind+solar in the NEM reportedly exceeded demand by ~14%; in Victoria the surplus was ~54%. Coal plants ran near minimums yet had to stay on for security of supply. Building more renewables without storage will exacerbate this situation.

Meanwhile, politicking continues. Last week, opposition MP Andrew Hastie urged his party to abandon the 2050 net-zero target. Regardless of politics, the above chart says hitting zero by 2050 is unlikely on current trajectories.

Grid-Scale Storage: What Actually Helps?

We need two kinds of storage:

Diurnal (hours): Move solar from day → evening.

Multi-day/weekly: Ride through wind/solar lulls.

Batteries

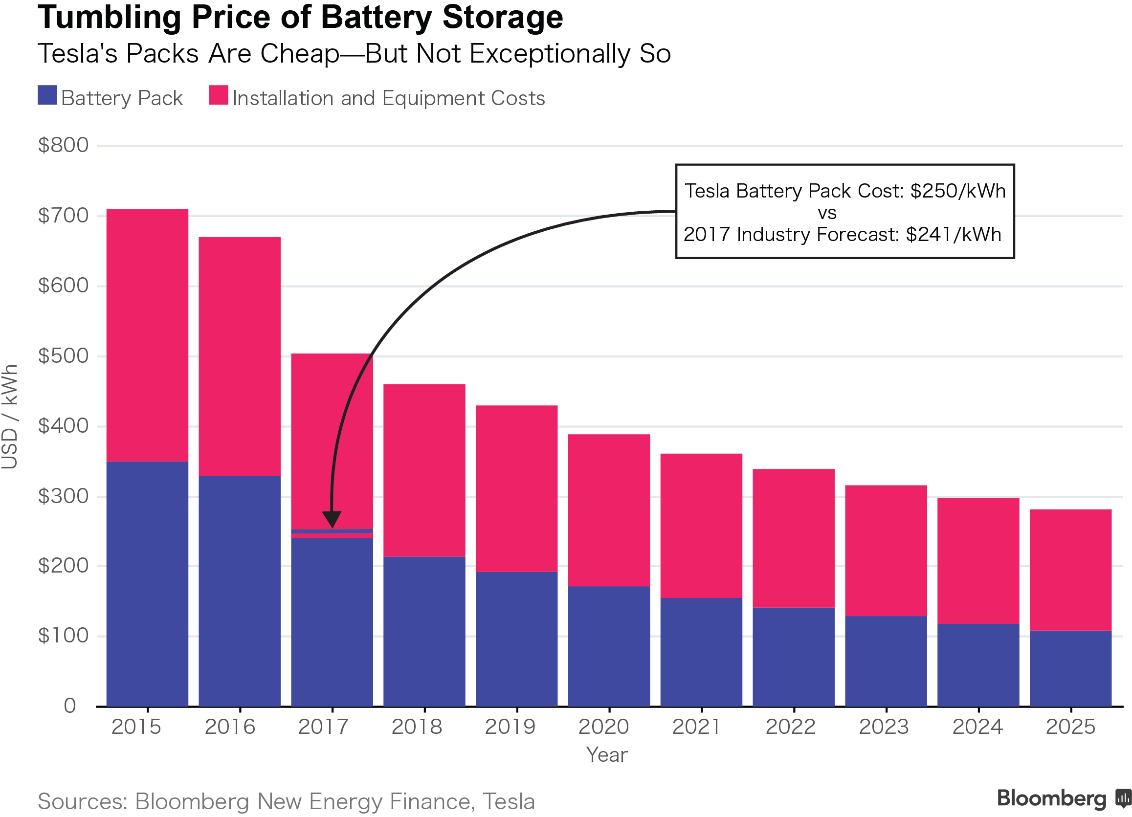

Costs keep falling as shown in the chart below, and many people claim batteries may be all we need. Pack prices (the blue bar in the chart) are the right basis for tech-to-tech comparison; BOS/installation (the red bar) is more project-specific.

Lazard’s 2024 LCOS (Levelised Cost of Storage) analysis puts utility 4-hour Li-ion around $124–$296/MWh in the U.S. with policy support. This is in broad agreement with the above chart. But either cost estimate presumes daily cycling. If you cycle once every few weeks, LCOS rises sharply because the same capex produces far fewer MWh. Batteries are not ideal for multi-day storage.

Hydrogen

Storing electricity as hydrogen is possible but inefficient. Electrolysis loses ~50%; power generation (turbine or fuel cell) loses another ~50%. Round-trip ~25% is typical (e.g., Duke Energy Florida achieved ~24%). You need ~4 kWh in to get ~1 kWh out. Unless costs plummet or efficiency improves, hydrogen is ill-suited for routine grid storage—though it can make sense for very long-duration or industrial needs.

Hydroelectrical Storage

Australia lacks the geography and water for extensive new pumped hydro. Some projects will go ahead; most won’t at the required scale.

Compressed Air Storage

CAES/A-CAES can be cost-effective given geology (caverns, mines). Australia has limited suitable sites. Aquifer concepts are promising but not yet proven at scale.

High-Temperature Thermal Storage (HT-TES)

Use surplus electricity to heat a storage medium (e.g., molten salt). Later, run a steam turbine (or, at higher temperatures, an sCO₂ turbine). Round-trip ~40% is already achievable at ~500–565 °C; ~60% may be possible with hotter stores and sCO₂, though that technology is still maturing. Even now, HT-TES can be the cheapest grid-scale option for multi-hour to multi-day firming.

Best of all, co-locate molten-salt tanks at existing steam plants:

You can heat feedwater/steam directly from the tanks (supplementing or bypassing the boiler).

Grid infrastructure already fans out from coal plants—ideal nodes to soak up surplus renewable energy.

China’s Suzhou Power Plant (the above photo) is a good example: an older 1,000-MW coal CHP retrofitted with two molten-salt tanks, enabling deep peak shaving and district heat while keeping the turbine flexible.

Capital cost of Molten Salt Storage

Much of the literature references Gemasolar-style two-tank nitrate systems (hot 565 °C, cold 290 °C).

All of the below cost figures are in US dollars.

Reference configuration (Gemasolar-like):

Nominal 20 MW Steam Rankine; η ≈ 40%; 15 h storage → 300 MWhₑ; ≈750 MWhₜₕ.

Cost basis (SAM, 2013): $27/kWhₜₕ (Turchi & Heath, Table 1). Adjusted to today ≈ $38/kWhₜₕ.

→ 750,000 kWhₜₕ × $38 ≈ $29 million for the TES system including salt.

Salt inventory estimate. Tanks ~10 m high, 20 m diameter; salt density ≈ 1,800 kg/m³. One full tank ≈ 5,700 t. At $700/t for premixed solar salt, salt cost ≈ $4.0 million (order-of-magnitude).

Implied hardware cost. $29M – $4M ≈ $25M for tanks, foundations, HX, pumps, piping, trace, E&I, etc., for a 300 MWhₑ system. This feels tight for two large tanks (one SS316/347H hot tank, one carbon-steel cold tank) plus balance-of-plant, but it’s in the right ballpark for early-2010s designs scaled to 2025 dollars.

Scaling Example: Callide

Callide is 1,500 MW or 75 times the Gemasolar capacity. A 15-hour TES would be 75× Gemasolar’s storage:

75 hot tanks (stainless), 75 cold tanks (carbon steel), each ~20 m × 10 m

Storage: 56,250 MWₜₕ

Capex (TES only): $29M × 75 ≈ $2.175 billion

Specific cost: ≈ $95,000/MWhₑ (TES component)

For context, South Australia’s “Tesla Big Battery” (Hornsdale) was ~150 MW / 194 MWh at a total capex of ~A$161 million (~US$600–800k per MWhₑ). TES is thus order-of-magnitude cheaper per MWhₑ of storage capacity, albeit with lower round-trip efficiency and a separate power block.

Conclusions

Australia must invest massively in grid-scale storage to meet net zero goals. Given our grid topology and coal-plant footprints, high-temperature thermal storage co-located at existing steam stations is a compelling option:

It is far cheaper per MWh of energy capacity than batteries.

It leverages existing grid nodes and steam turbines.

It complements batteries (fast response) with multi-hour to multi-day firming.

Batteries will play a major role in short-duration and ancillary services. For bulk shifting and deep firming, molten-salt HT-TES deserves to be front and centre.

References

Global CSP Molten Salt Market Research Report 2025 https://www.qyresearch.com/reports/4800346/csp-molten-salt

Prieto, C., Tagle-Salazar, P. D., Patiño, D., Schallenberg-Rodriguez, J., Lyons, P., & Cabeza, L. F. (2024). Use of molten salts tanks for seasonal thermal energy storage for high penetration of renewable energies in the grid. Journal of Energy Storage, 86, 111203.

Tehrani, S. S. M., Taylor, R. A., Nithyanandam, K., & Ghazani, A. S. (2017). Annual comparative performance and cost analysis of high temperature, sensible thermal energy storage systems integrated with a concentrated solar power plant. Solar Energy, 153, 153-172.

Turchi, C. S., & Heath, G. A. (2013). Molten salt power tower cost model for the system advisor model (SAM) (No. NREL/TP-5500-57625). National Renewable Energy Laboratory (NREL), Golden, CO (United States).